Commercial

commercial

To better serve investors with the need to allocate funds but don’t want to hold properties, UFUND Investment provides direct and indirect undervalued commercial investment opportunities locally and nationwide. Utilizing our resources in 48 states and years of experience, we are able to identify high-quality projects, diversify deals types, create multiple ways to invest, and satisfy both risk-averse investors’ and opportunists’ needs.

To participate, we provide UFUND Real Estate Fund and Projects as options.

UFUND Real Estate Fund

UFUND Real Estate Fund (The Fund) is an open-ended fund based on real estate loans and assets.

Specializing in off-market, undervalued residential and commercial properties for over a decade, the UFUND team uses creative problem-solving and deal structures, which lays a solid foundation for providing great investment opportunities to a wide range of investors. The fund is designed to provide high quality, consistent income, and growth, via portfolio diversification over a range of products to maximize risk-adjusted ROI, which includes:

- Origination and Acquisition of Mortgage Loans

- Investment in Income Residential Rental Portfolio

- Investment in Real Estate Ownership

UFUND Capital Fund

UFUND Capital is a close-ended fund focusing on off-market real estate assets.

The strategies of UFUND Capital are:

-

Specialize in Distressed, Value-Add and Cash-flowing opportunities

-

Exclusive Co-GP positions that offer higher returns and earn promote

-

Risk management through strong relationships, diversification, and well-defined processes

-

Access high-quality GP investment positions and diverse US real estate assets for superior risk-adjusted returns across extensive geographic territories.

Projects

UFUND Investment offers investors opportunities to invest in individual commercial projects as Limited Partners. Usually, investors are sharing equity with General Partners, and returns consist of routine cash distribution and back-end profits.

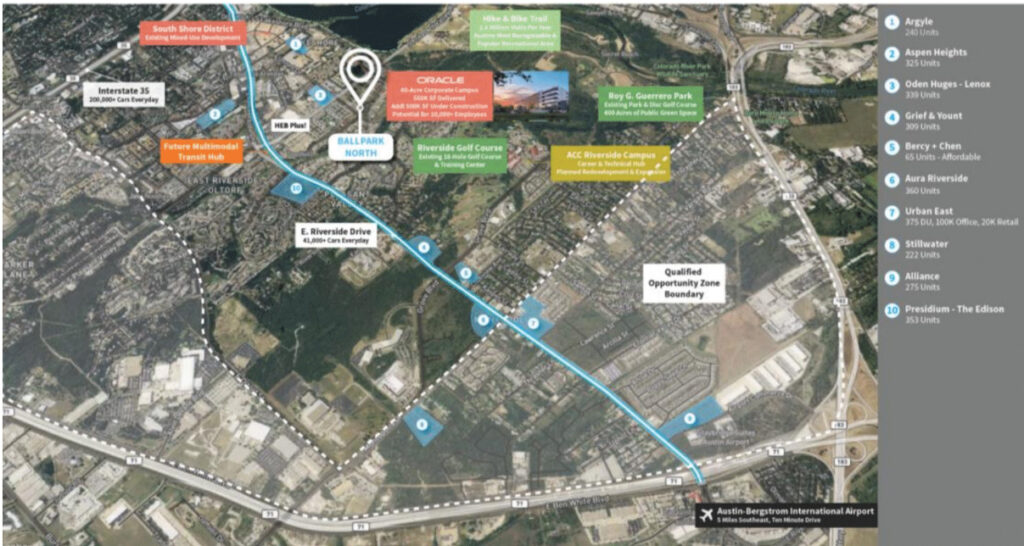

Austin Downtown Student Apartments

Property Type: Student Housing

Size:22.7 Acres

Modeled Hold Period:5 Years

Exit Strategy: Sell or Refinance

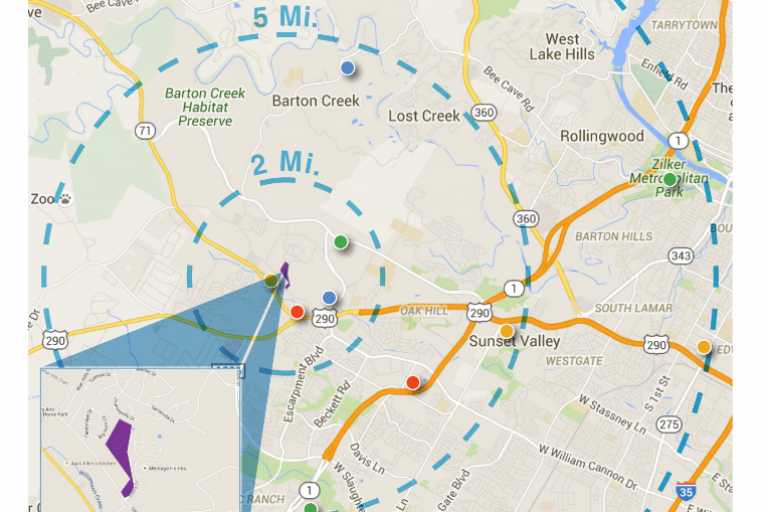

Upcoming in Austin, one of the nation’s top economic performers, we have a student housing project which includes Ballpark North and Town Lake apartments. The properties have walkable access to Lady Bird Lake, Ann & Roy Butler Hike & Bike Trail, Roy Guerrero Park, the recently developed retail shops along East Riverside Drive, and the pedestrian bridge access to Cesar Chavez Rd in East Austin. The

properties provide a central location with close proximity to downtown Austin, University of Texas, and Austin-Bergstrom International Airport. The properties are adjacent to the 550K Oracle Campus, HEB Plus, and have straightway access to I35,and is only a few minutes from downtown.

Rezoning has been approved on Oct. 17th, the largest rezoning in the history of Austin, it took a couple of years efforts to get where we are today finally. Project team seeks to qualify the properties asexempt from property taxes owed to the state of Texas by partnering with the housing authority of the city of Austin, a Texas municipal housing authority and the government entity (HACA)

Virginia

- Goal: Rehab and Value Added

- Portfolio: SFH

- Term: 6 months to 9 months

- Purchase price: 30% below market price

- Exit Strategy: Sold

- Project Team: Local top player in the field

This project has already exited.

Lending with pledged properties in 1st lien with LTV not exceeding 75%. All properties are located in hot investment areas and easily rented or sold. The project team is a long-term UFund Investment partner.

Colorado

- Goal: Rehab and Value Added

- Portfolio: SFH

- Term: 6 months to 9 months

- Purchase price: 30% below market price

- Exit Strategy: Sold

- Project Team: Local top player in the field

This project has already exited.

Lending with pledged properties in 1st lien with LTV <70%. All properties are located in hot investment areas, such as Colorado Springs. Properties are easily rented or sold.

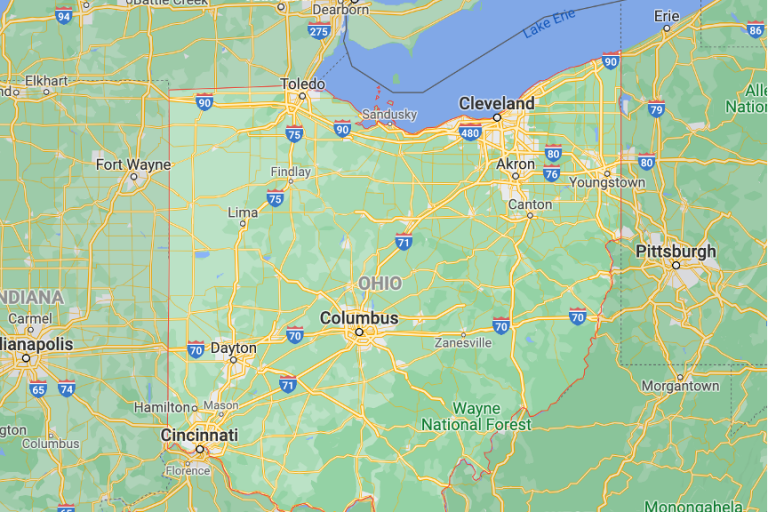

Ohio

- Goal: Rehab and Value Added

- Portfolio: Apartments

- Term: 12 months

- Purchase price: 30% below market price

- Exit Strategy: Refinanced

- Project Team: Local top player in the field

This project has already exited.

Lending with pledged properties in 1st lien with LTV not exceeding 75%. All properties are located in hot investment areas. Properties were purchased undervalued ($37/sqf) and rented below market value. The project team plans to renovate and hold properties

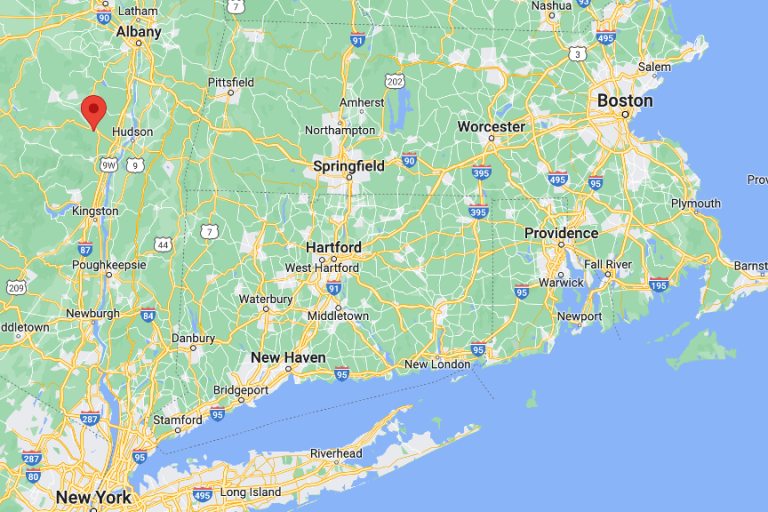

NY Lending Project

- Goal: Rehab and Value Added

- Portfolio: SFH

- Loan Duration: 6 months

- Lien Position: 1st Lien

- LTV: <75%

- Distribution: every 3 months

- Exit Strategy: Refinance or Sale

- Project Team: Local top player in the field

UFUND Austin Fitzroy Apartment Project

- Goal: Rehab and Value Added

- Portfolio: Multi-family Development Project

- Number of Units: 440

- Projected Timeline: 3.5-5 years

- Exit Strategy: Sponsor will sell the property after stabilization.

- Project Team: Local top player in the field

Ohio Multifamily Lending Project

- Strategy: Value-Add. Multifamily Rehab

- Date of Investment: 5/2021

- Loan Duration: 12 months

- Lien Position: 1st Lien

- LTV: <75%

- Distribution: Every 3 months

- Has Personal Guaranty

- Exit Strategy: Refinance or Sale

- Project Team: Local top player in the field

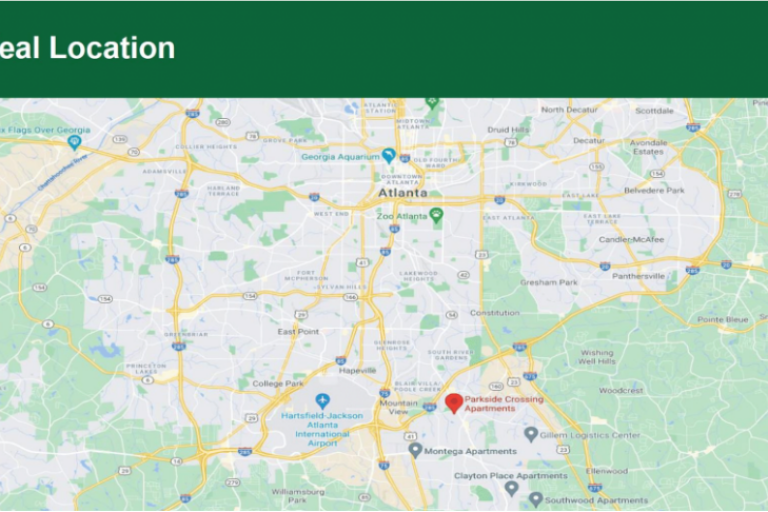

Atlanta Parkside Crossing Lending

- Strategy: Value-Add. Multifamily Rehab

- Date of Investment: 8/2021

- Loan Duration: 6 months

- Lien Position: 2nd Lien

- Distribution: every 3 months

- Has Personal Guaranty

- Exit Strategy: Refinance or Buyout

- Project Team: Local top player in the field

OHIO Residential Properties Lending

- Strategy: Value-Add. Multifamily Rehab

- Date of Investment: 9/2021

- Loan Duration: 24 months

- Lien Position: 2nd Lien

- Total LTC: <60%

- Distribution: every 3 months

- Has Personal Guaranty

- Exit Strategy: Refinance or Sale

- Project Team: Local top player in the field

UFUND Short Term Private Lending

- Strategy: UFUND’s Assets Acquisitions Expansion

- Date of Investment: 12/2021

- Loan Duration: 12-18 months

- Lien Position: 1st Lien

- LTV: 70%

- Distribution: every 3 months

- Has Personal Guaranty

- Exit Strategy: Buyout

- Project Team: Local top player in the field

Bee Cave Vista Lending

- Strategy: SFH Buit-to-Rent Community Development

- Date of Investment: 5/2018

- Type 1: 2nd Phase in equity

- Type 2: Mezzanine Lending

- With Borrower’s Personal Guaranty

- Loan Duration: 24 months

- Distribution: Due on mature date

- Exit: Sold in 2020

- Project Team: Local top player in the field

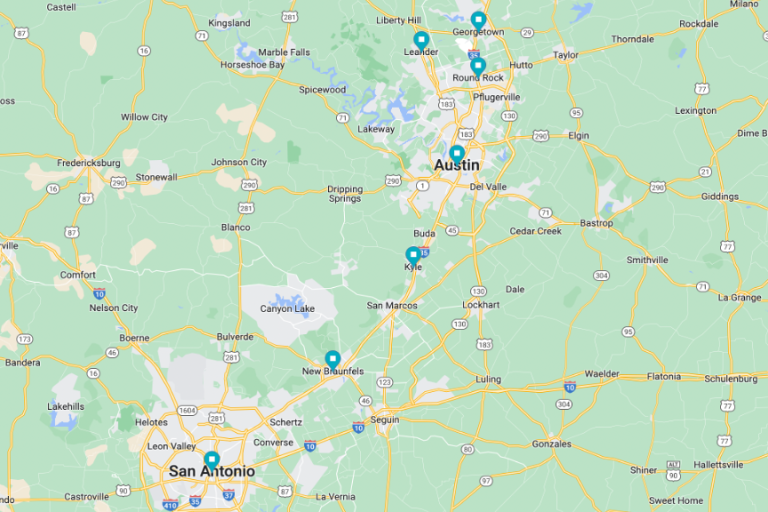

Leander Downtown Built To Rent

- Project Type: Land Development (Phase I) for Built To Rent Project

- Location: Leander Downtown, Austin MSA, TX

- Date of Investment: Aug 2021

- Acreage of the Land: 13.5 acres

- Projected Timeline: 9-12 months

- Exit Strategy: Sponsor will sell the land. UFUND Investors have the unique option to exit at end of Phase I, or continue to invest in Phase II

- Project Team: Local top player in the field

6300 Westpark Commercial Project

- Project Type: Off-Market Flex Space Commercial Project

- Location: Galleria area, Houston, TX

- Date of Investment: Oct 2018

- Projected Timeline: 3-5 years

- Exit Strategy: Sponsor will buy out investors’ shares or sell the property

- Project Team: Local top player in the field

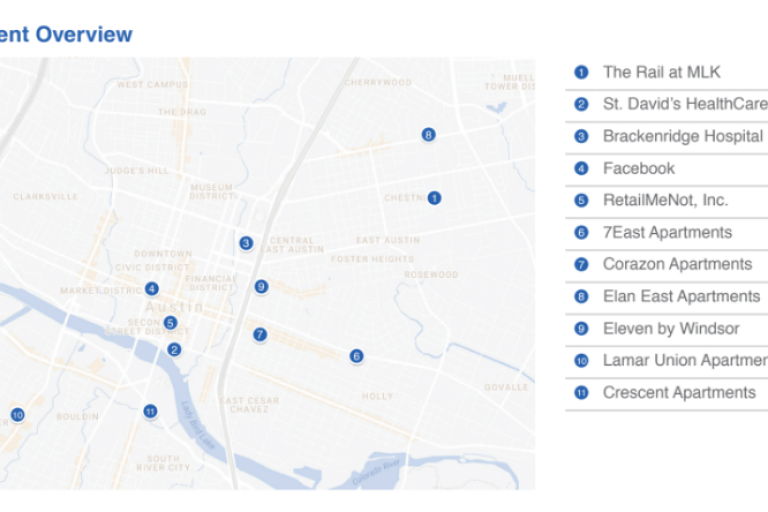

The Rail at MLK Project

- Project Type: Mixed-use Multi-family Building Development Project

- Location: Austin, TX

- Date of Investment: Aug 2018

- Number of Units: 5000

- Projected Timeline: 6 years

- Exit Strategy: Sponsor will sell the property after stabilization.

- Project Team: Local top player in the field

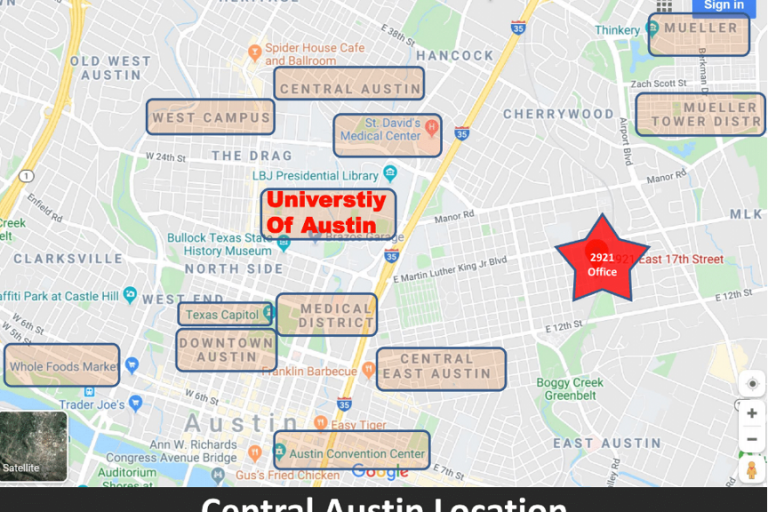

2921 Office Building Project

- Project Type: Office Building Value-Add Project

- Location: Downtown Austin, TX

- Date of Investment: June 2018

- Projected Timeline: 3-5 years

- Exit Strategy: Original plan is to add 5,500 sqft in the 2nd year, but sponsor decided to maintain the same layout and hold. Sponsor will sell the property after current lease expires.

- Project Team: Local top player in the field

San Antonio Built-To-Rent

- Project Type: Land Development (Phase I) for Built To Rent Project

- Location: San Antonio, TX

- Date of Investment: Dec 2021

- Acreage of the Land: 17.26 acres

- Projected Timeline: 6 -12 months

- Exit Strategy: Sponsor will sell the land. UFUND Investors have the unique option to exit at end of Phase I, or continue to invest in Phase II

- Project Team: Local top player in the field

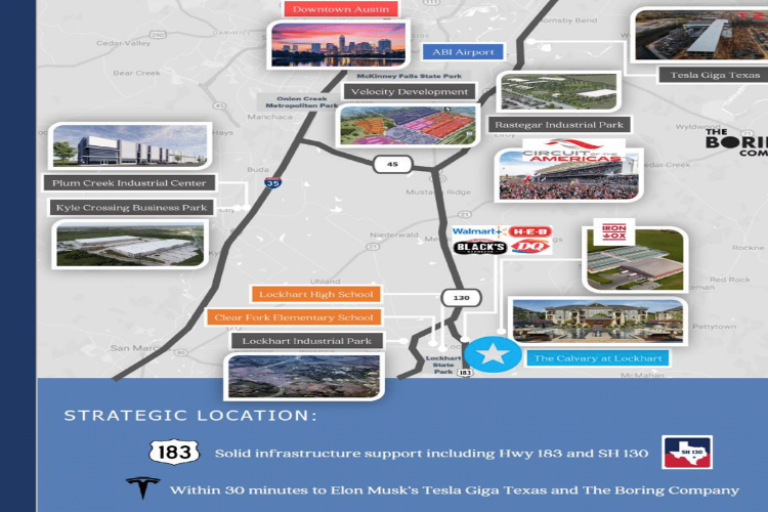

Lockhart Apartment in Austin Greater Area

- Project Type: Multi-family Development Project

- Location: Lockhart, Austin MSA, TX

- Date of Investment: Oct 2021

- Number of Units: 216

- Projected Timeline: 3-5 years

- Exit Strategy: Sponsor will sell the property after stabilization.

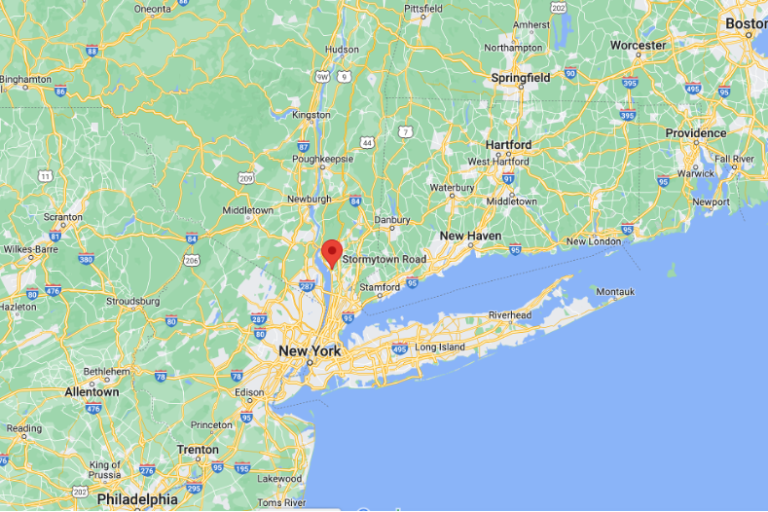

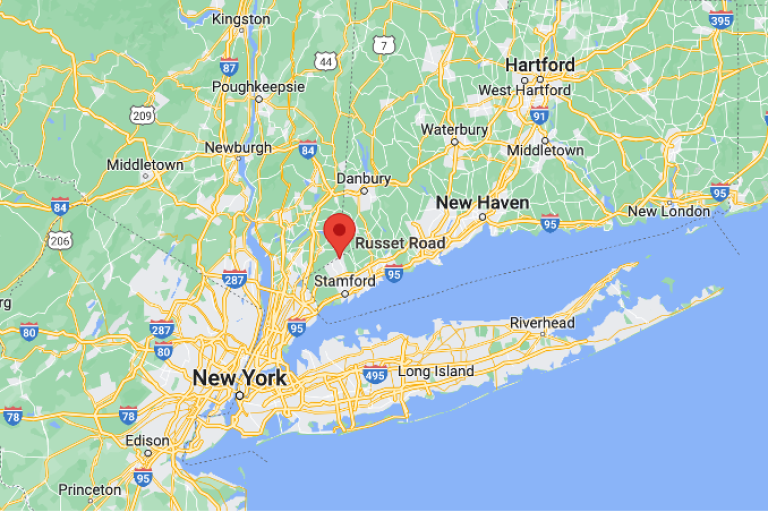

NY SFH Short Term Lending

- Project Type: Single family

- Location: New York

- Date of Investment: Jun 2022

- Loan Duration: 12 months

- Distribution: every 3 months

- Exit Strategy: Refinance

UFUND Commercial LLC-Series B

- Project Type: Single family

- Date of Investment: Apr 2022

- Loan Duration: 12-18 months

- Distribution: every 3 months

- Exit Strategy:Refinance or Sale

CT Single Family House Short Term Lending

- Project Type: Single Family

- Date of Investment: Mar 2022

- Loan Duration: 9-12 months

- Distribution: every 3 months

- Exit Strategy: Sponsor will sell the property after stabilization.

NY Small Multifamily Short Term Lending

- Project Type: Multi-family Development Project

- Date of Investment: Feb 2022

- Loan Duration: 9-12 months

- Distribution: every 3 months

- Exit Strategy: Sponsor will sell the property after stabilization.

Waco Zoe Multi-family Development

- Project Type: Multi-family Development Project

- Location: Waco, TX

- Date of Investment:June 2022

- Number of Units: 214

- Projected Timeline:18-24 Months

- Exit Strategy: Sponsor will sell the property after stabilization.

SC Multifamily Development WhiteHorse

- Project Type: Multi-family Development Project

- Location: Greenville, SC

- Date of Investment: May 2022

- Number of Units: 96

- Projected Timeline: 16-24 Months

- Exit Strategy: Sponsor will sell the property

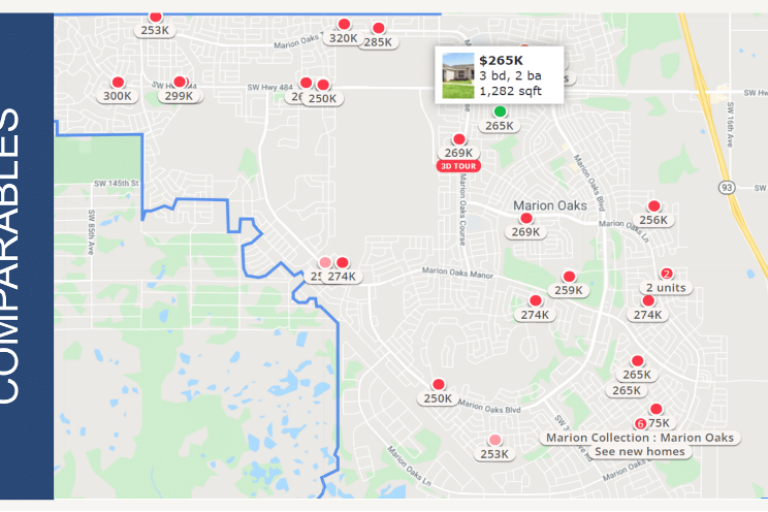

Florida Student Housing

- Project Type: Multi-units Student Housing Project

- Location: Gainesville, FL

- Date of Investment: Feb 2022

- Number of Units: 924

- Projected Timeline: 5 years

- Exit Strategy: Sponsor will sell the property after stabilization.