Products

products

Full-Service Rentals

UFUND Investment has been maintaining strong relationships with many off-market real estate top players in 48 states of the United States.

We have early access to their best deals and select carefully to meet our investors’ needs. In addition, each full service rental is sold with a local professional management team in line and possibly even with tenant occupancy.UFUND Full-Service Rentals bring investors true hassle-free real estate investment to you and help you easily scale up like financial products.

Commercial

To better serve investors with the need to allocate funds but don’t want to hold properties, UFUND Investment provides direct and indirect undervalued commercial investment opportunities both locally and nationwide. Utilizing our resources in 48 states and years of experience, we are able to identify high-quality projects, diversify deal types, create multiple ways to invest, and satisfy both risk-averse investors’ and opportunists’ needs.

To participate, we provide UFUND Real Estate Fund and Projects as options.

UFUND Real Estate Fund

UFUND Real Estate Fund (The Fund) is a fund based on real estate loans and assets.

Specializing in off-market, undervalued residential and commercial properties for over a decade, the UFUND team uses creative problem-solving and deal structuring to create a solid foundation for providing great investment opportunities to a wide range of investors. The fund is designed to provide high quality opportunities with consistent income and growth via portfolio diversification over a range of products to maximize risk-adjusted ROI, which includes:

- Origination and Acquisition of Mortgage Loans

- Investment in Income Residential Rental Portfolio

- Investment in Real Estate Ownership

UFUND Capital Fund

UFUND Capital is a fund focusing on off-market real estate assets. Specializing in off-market, undervalued residential and commercial properties for over 15 years.

It is designed to provide high quality opportunities with consistent income and growth, via portfolio diversification over a range of products to maximize risk-adjusted ROI, which include:

- Origination and Acquisition

of Mortgage Loans - Investment in Income

Residential Rental Properties - Investment in Real Estate

Ownership

Differentiated Strategies

- Specialize in Distressed, Value-Add and Cash-flowing opportunities

- Partnering with established institutional-grade firms and developers with strong track records for high-yield development deals

- Exclusive Co-GP positions that offer higher returns earn promote

- Risk management through strong relationships, diversification, and well-defined processes

Projects

UFUND Investment offers investors opportunities to invest in individual commercial projects as Limited Partners with the opportunity to share equity with General Partners and receive returns consisting of routine cash distribution and back-end profits.

Fitzroy Apartment in Austin Greater Area

- Project Type: Multi-family Development Project

- Location: Liberty Hill, Austin MSA, TX

- Date of Investment: July 2021

- Number of Units: 440

- Projected Timeline: 3.5-5 years

- Estimated Investor IRR: 17.68%

- Exit Strategy: Sponsor will sell the property after stabilization.

Austin Downtown Student Apartments

Property Type: Student Housing

Size:22.7 Acres

Modeled Hold Period:5 Years

Exit Strategy: Sell or Refinance

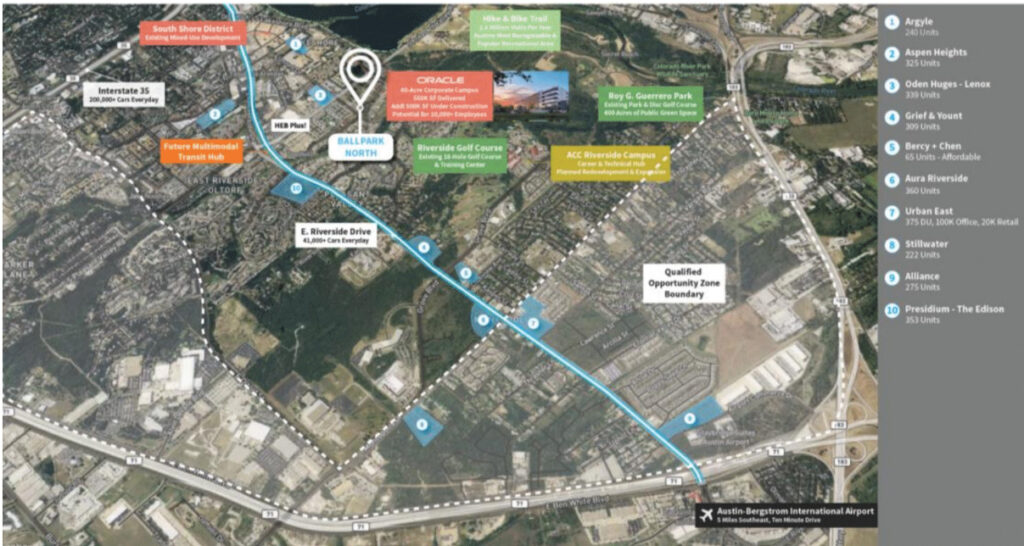

Upcoming in Austin, one of the nation’s top economic performers, we have a student housing project which includes Ballpark North and Town Lake apartments. The properties are within walking distance to Lady Bird Lake, Ann & Roy Butler Hike & Bike Trail, Roy Guerrero Park, the recently developed retail shops along East Riverside Drive, and the pedestrian bridge access to Cesar Chavez Rd in East Austin. The properties are in a central location , being in the proximity of downtown Austin, University of Texas, and Austin-Bergstrom International Airport. The properties are adjacent to the 550K Oracle Campus and HEB Plus, have straightway access to I35, and are only a few minutes from downtown.

The largest rezoning in the history of Austin was just approved on Oct. 17th. It took a couple of years of effort to finally get where we are today. Project team seeks to qualify the properties as exempt from property taxes owed to the state of Texas by partnering with the housing authority of the city of Austin, a Texas municipal housing authority and the government entity (HACA).

Personalized Agent Service

Ufund Investment, LLC is a full-service Real Estate Brokerage that provides a team of experts to best serve you in the greater Austin metropolitan area. We’ve been in the Austin real estate market for over 20 years focusing on Off Market, underwriting deals in large volume every day. We provide a solid analysis on the local real estate market in general and also run daily analyses on every property based on:

- How to get the most value out of a property

- Pricing strategy

- Return On Investment (ROI)

- Negotiation strategy

- Exit strategy

Wholesaling

UFUND Investment seeks out discounted Off-Market residential and commercial properties exclusively for our clients.

We have extensive knowledge and experience finding and acquiring off-market distressed properties. Our value-added opportunities provide you with exceptional returns on your real estate investments. We take pride in providing superior customer service and developing long-term relationships with our investor partners.

Why Ufund?

- We have a full team with a variety of different expertise to service each one of our clients.

- We are experts at analyzing and underwriting deals in large volumes every day, which is a crucial skill to run a successful wholesale business. As a result, we are able to precisely estimate a property’s market value and guide our clients towards the best pricing strategy.

- Our team has exceptional negotiation skills because we handle thousands of off-market negotiations and problem-solve all day long.

- We provide 50% more opportunities to our clients because we are in both on market (Retail) and off-market real estate markets rather than just the traditional retail real estate market

- Our team understands repair costs very well from our wholesale and flipping house business, which can help provide our clients with more accurate repair cost evaluations.